The stock market offers exciting opportunities to grow your wealth, but navigating it successfully requires understanding both the process and potential pitfalls. Whether you’re looking to invest for retirement or generate additional income, knowing how to trade stocks properly is essential for long-term success. This comprehensive guide walks you through the entire trading journey—from opening your first brokerage account to executing trades and implementing crucial safeguards to protect your investments.

Ready to Start Your Trading Journey?

Join thousands of new investors who are building their financial future through smart, informed trading.

Understanding the Stock Market Basics

Before diving into the trading process, it’s important to grasp what the stock market actually is. At its core, the stock market is a collection of exchanges where shares of publicly traded companies are bought and sold. When you purchase a stock, you’re buying a small ownership stake in that company.

The two main stock exchanges in the United States are the New York Stock Exchange (NYSE) and the Nasdaq. These marketplaces connect buyers with sellers and determine stock prices through supply and demand. Today’s trading happens almost entirely electronically, with orders executed in fractions of a second.

Pro Tip: Before placing your first trade, spend time learning market terminology. Understanding terms like bid, ask, market cap, and P/E ratio will help you make more informed decisions and communicate effectively with brokers.

Setting Up a Brokerage Account

The first practical step in your trading journey is selecting a broker and opening an account. A broker acts as your intermediary to the market, executing buy and sell orders on your behalf.

Choosing Between Online and Traditional Brokers

Modern investors typically choose between two main types of brokers:

Online Brokers

- Lower fees and commissions

- User-friendly platforms and mobile apps

- Self-directed trading experience

- Extensive research tools and educational resources

- Quick account setup (often within minutes)

Traditional Brokers

- Personalized investment advice

- Face-to-face interaction

- Portfolio management services

- More comprehensive financial planning

- Higher fees for premium service

Required Documents for Account Opening

To open a brokerage account, you’ll typically need to provide:

- Government-issued photo ID (driver’s license or passport)

- Social Security Number or Tax ID

- Employment information and source of income

- Basic financial information (net worth, investment objectives)

- Bank account details for funding

Account Verification Process

Most brokerages follow a standard verification process:

- Complete the online application form

- Verify your identity (may require uploading ID documents)

- Answer questions about your investment experience and goals

- Review and accept terms and conditions

- Receive account approval (typically within 1-3 business days)

“Choosing the right broker is one of the most important decisions you’ll make as a new trader. Look beyond just fees—consider the quality of their research tools, educational resources, and customer support.”

— Experienced Market Analyst

Funding Your Trading Account

Once your account is approved, the next step is adding funds so you can begin trading. Most brokerages offer several funding methods, each with different processing times and potential limitations.

Common Deposit Methods

| Funding Method | Processing Time | Advantages | Limitations |

| ACH Bank Transfer | 1-3 business days | Free, convenient, can be automated | Potential transfer limits |

| Wire Transfer | Same day or next day | Fast processing, higher limits | Fees ($10-$30 typically) |

| Check Deposit | 5-7 business days | No electronic transfer needed | Slowest method, mail delays |

| Account Transfer | 3-10 business days | Move existing investments | Complex paperwork, potential fees |

Minimum Deposit Requirements

Minimum deposit requirements vary widely between brokerages:

- Many online brokers now offer $0 minimum accounts

- Specialized trading accounts may require $2,000+ (like margin accounts)

- Premium services often require higher minimums ($10,000+)

- Consider starting with more than the minimum to avoid cash flow issues

Important: Understand the settlement period for your deposits. While some brokers offer instant buying power for a portion of your deposit, the full amount typically takes 1-3 business days to settle completely. This affects when you can withdraw funds after selling stocks.

Researching Stocks Before Trading

Successful trading begins with thorough research. Before investing your hard-earned money, take time to identify promising stocks and understand what makes them valuable. There are two primary approaches to stock analysis: fundamental and technical.

Fundamental Analysis Tools

Fundamental analysis examines a company’s financial health and business model to determine its intrinsic value. Key resources include:

Financial Statements

- Annual reports (10-K)

- Quarterly reports (10-Q)

- Income statements

- Balance sheets

- Cash flow statements

Key Financial Ratios

- Price-to-Earnings (P/E)

- Price-to-Book (P/B)

- Debt-to-Equity

- Return on Equity (ROE)

- Earnings per Share (EPS)

Industry Analysis

- Competitive positioning

- Market share trends

- Industry growth projections

- Regulatory environment

- Disruptive technologies

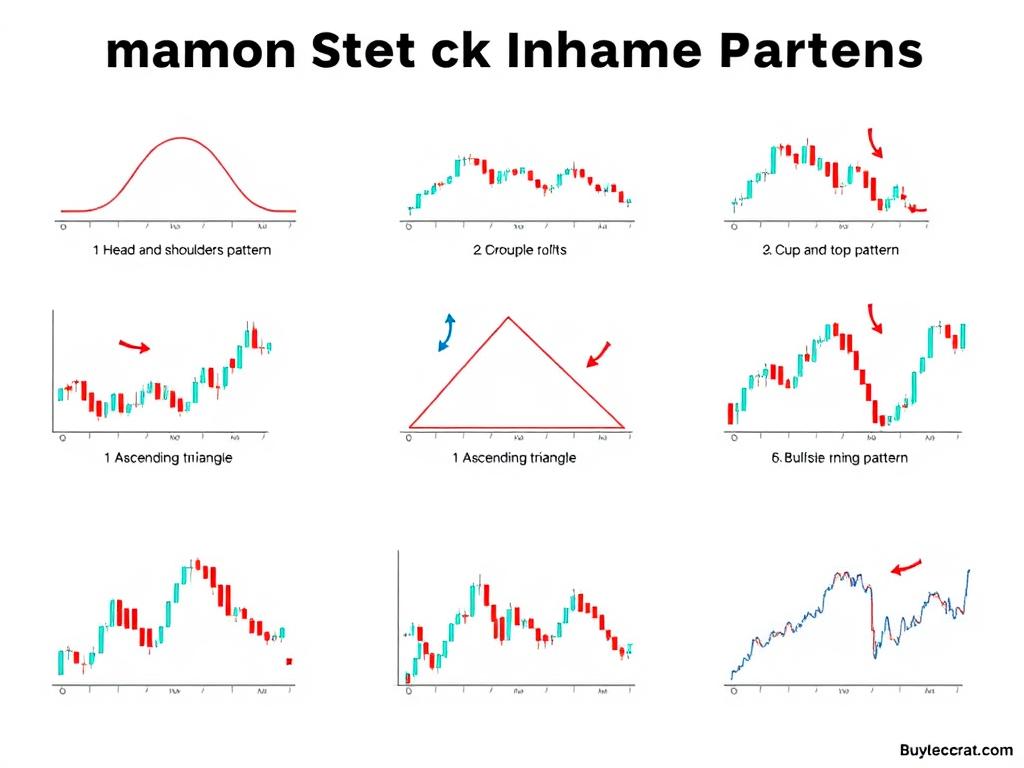

Technical Analysis Strategies

Technical analysis studies price movements and trading volumes to identify patterns and predict future price behavior. Essential tools include:

Chart Patterns

- Support and resistance levels

- Head and shoulders patterns

- Double tops and bottoms

- Triangles and wedges

- Cup and handle formations

Technical Indicators

- Moving averages (50-day, 200-day)

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Bollinger Bands

- Volume indicators

Stock Screening Tools

Stock screeners help you filter through thousands of stocks based on specific criteria. Popular free screeners include:

- Finviz.com – Comprehensive visual screener with excellent filtering options

- Yahoo Finance – User-friendly screener with fundamental and technical filters

- TradingView – Advanced charting platform with screening capabilities

- Your brokerage platform – Most offer built-in screening tools

Caution: Don’t rely solely on stock tips from social media, forums, or “hot stock” newsletters. These sources often promote stocks without proper research or may have undisclosed conflicts of interest. Always conduct your own analysis before investing.

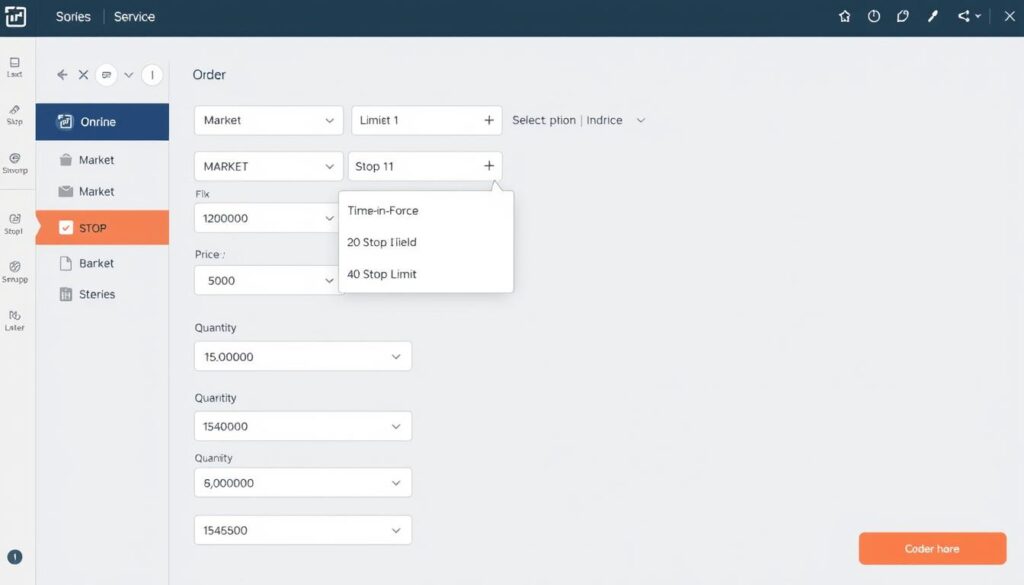

Understanding Different Order Types

When you’re ready to trade, you’ll need to understand the various order types available. Each serves a specific purpose and can significantly impact your trading outcomes. Choosing the right order type for your situation is a crucial part of the stock trading process.

Primary Order Types Explained

| Order Type | Description | Best Used When | Risks |

| Market Order | Executes immediately at the best available current price | You want guaranteed, immediate execution and price is less important than speed | May execute at a price significantly different from what you saw, especially in volatile markets |

| Limit Order | Executes only at your specified price or better | You have a specific price target and are willing to wait for it | May never execute if the market doesn’t reach your price |

| Stop Order (Stop-Loss) | Becomes a market order when a specified price is reached | You want to limit potential losses or protect profits | Can execute at prices far below your stop price during rapid market moves |

| Stop-Limit Order | Combines stop and limit orders; triggers at stop price but executes only at limit price or better | You want protection but also price control | May not execute at all if price moves quickly past your limit price |

| Trailing Stop Order | Stop price adjusts automatically as stock price moves in your favor | You want to protect profits while letting winners run | Can be triggered by temporary price fluctuations |

Time-in-Force Instructions

When placing orders, you’ll also need to specify how long your order remains active:

- Day Order: Valid only for the current trading day

- Good-Till-Canceled (GTC): Remains active until filled or manually canceled (typically up to 90 days)

- Fill-or-Kill (FOK): Must be filled immediately and completely or canceled

- Immediate-or-Cancel (IOC): Fills what’s possible immediately and cancels the rest

Pro Tip: For beginners, limit orders are often safer than market orders when trading less liquid stocks. They protect you from unexpected price jumps and ensure you never pay more than your specified price.

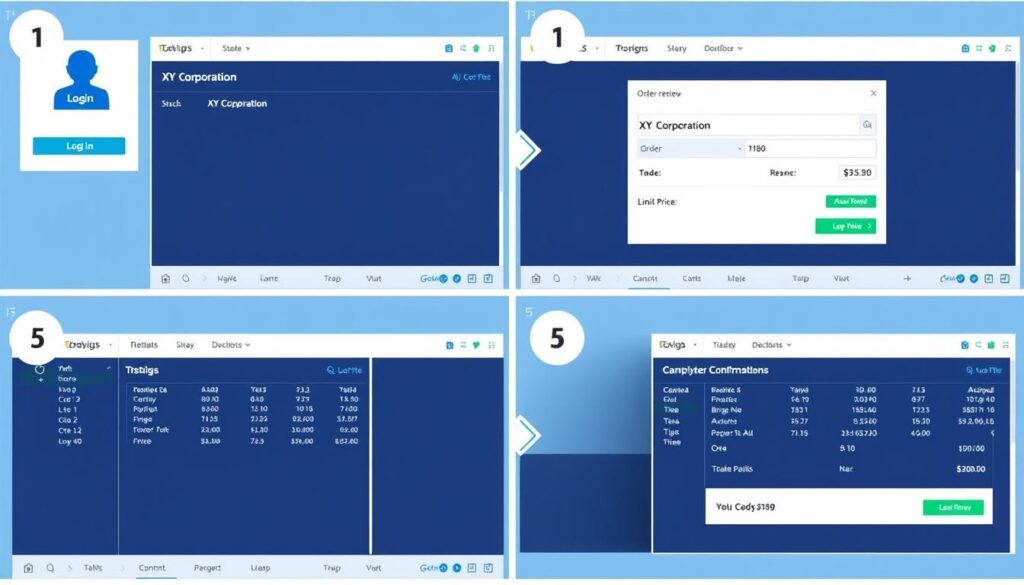

Executing Your First Trade: A Step-by-Step Example

Let’s walk through a hypothetical first trade to illustrate the process. In this example, we’ll purchase 10 shares of XYZ Corporation, a stable company you’ve researched thoroughly.

- Log in to your brokerage account using your username and password. Navigate to the trading section of the platform.

- Enter the stock symbol in the search box. For our example, enter “XYZ” and select XYZ Corporation from the results.

- Review the stock information including current price, daily range, and recent performance. Let’s say XYZ is currently trading at $50.25 per share.

- Click “Buy” or “Trade” to open the order form. Enter the quantity (10 shares) and select your order type (let’s use a limit order at $50.50).

- Choose your time-in-force instruction (Day order for this example).

- Review the order details carefully. The total cost will be approximately $505.00 plus any commission.

- Submit your order by clicking “Place Order” or “Submit.”

- Receive confirmation that your order has been received and is either filled, partially filled, or pending.

After Your Order is Filled

Once your order executes successfully:

- You’ll receive a trade confirmation with details of your purchase

- The shares will appear in your portfolio, usually immediately

- Your account balance will be reduced by the purchase amount plus any fees

- You can track the performance of your new position in your portfolio dashboard

“Your first trade might feel intimidating, but remember that even the most successful investors started with a single purchase. Focus on making an informed decision rather than trying to time the market perfectly.”

Essential Precautions for New Traders

Trading stocks involves inherent risks that can lead to significant financial losses if not properly managed. Implementing these precautions will help protect your capital and improve your chances of long-term success.

Risk Management Strategies

Essential Precautions

- Set stop-loss orders for every position to limit potential losses

- Diversify across sectors to reduce exposure to industry-specific risks

- Start with small position sizes until you gain experience

- Never invest emergency funds or money needed for essential expenses

- Keep detailed records of all trades and your reasoning behind them

- Use practice accounts before committing real money

- Understand tax implications of your trading activity

Warning Signs to Watch For

- Emotional decision-making based on fear or greed

- Overtrading or excessive transaction costs

- Chasing performance or trying to time market bottoms/tops

- Ignoring position sizing and risking too much on single trades

- Following “hot tips” without doing your own research

- Averaging down on losing positions without a clear strategy

- Neglecting to review and learn from your trading history

Position Sizing Guidelines

Proper position sizing is crucial for managing risk. Consider these guidelines:

- Limit each position to 2-5% of your total portfolio value

- Reduce position size for more volatile stocks

- Increase position size gradually as you gain experience and capital

- Calculate maximum loss per trade and ensure it’s an amount you can comfortably lose

Important Warning: Never trade with borrowed money or use excessive margin, especially as a beginner. Leverage can amplify losses just as easily as gains and has been the downfall of many traders.

Creating a Trading Plan

A written trading plan helps remove emotion from your decisions and provides a framework for consistent results. Your plan should include:

Entry Criteria

- Specific technical patterns or indicators

- Fundamental requirements (P/E ratio, growth rate, etc.)

- Market conditions that must be present

- Risk/reward ratio minimums

Exit Criteria

- Profit targets (percentage or price level)

- Stop-loss levels (percentage or support levels)

- Time-based exits if applicable

- Fundamental changes that warrant selling

Common Beginner Mistakes to Avoid

Even with the best intentions, new traders often fall into predictable traps. Being aware of these common mistakes can help you avoid them and accelerate your learning curve.

Research Mistakes

- Trading based solely on news headlines

- Following social media “gurus” without verification

- Confusing a good company with a good stock

- Ignoring the company’s financial health

- Not understanding the industry context

Execution Mistakes

- Using market orders when limit orders are safer

- Trading during market open/close volatility

- Ignoring liquidity concerns with smaller stocks

- Failing to confirm order details before submitting

- Not understanding all fees and commissions

Psychological Mistakes

- Holding losing positions too long

- Taking profits too early

- Revenge trading after losses

- Overconfidence after winning streaks

- Trading out of boredom or excitement

The Importance of a Trading Journal

Maintaining a detailed trading journal is one of the most effective ways to identify and correct mistakes. For each trade, record:

- Date, time, and stock symbol

- Entry and exit prices

- Position size and total investment

- Your reasoning for entering the trade

- Market conditions and relevant news

- Your emotional state before, during, and after the trade

- What went well and what could be improved

Learning Opportunity: Review your trading journal monthly to identify patterns in your successful and unsuccessful trades. This practice alone can dramatically improve your results over time.

Conclusion: Your Path Forward in Stock Trading

Stock trading is both an art and a science that requires continuous learning and adaptation. By understanding the complete trading process and implementing proper precautions, you can navigate the markets with greater confidence and improve your chances of long-term success.

Remember that even the most successful investors started as beginners. What separates those who succeed from those who fail is often not intelligence or luck, but discipline, patience, and a commitment to ongoing education. Start small, learn from each trade, and gradually build your skills and portfolio over time.

Ready to Start Your Trading Journey?

Apply what you’ve learned and begin building your investment portfolio with confidence. Open an account with a reputable broker today and take your first steps toward financial growth.

Or try a free demo account to practice without risk.

“The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett

Start small, learn continuously, and trade responsibly. Your future self will thank you for the time and effort you invest in mastering the stock trading process and precautions today.

Frequently Asked Questions

How much money do I need to start trading stocks?

Many online brokers now offer accounts with no minimum deposit requirements. However, to build a properly diversified portfolio, it’s advisable to start with at least 0-

Frequently Asked Questions

How much money do I need to start trading stocks?

Many online brokers now offer accounts with no minimum deposit requirements. However, to build a properly diversified portfolio, it’s advisable to start with at least $500-$1,000. Remember that individual stock prices vary widely—some trade for under $10 while others cost hundreds or thousands per share. You can start with whatever amount you’re comfortable investing, but ensure it’s money you can afford to lose.

How are stock trading gains taxed?

In the United States, stock trading profits are subject to capital gains tax. Short-term gains (from stocks held less than one year) are taxed at your ordinary income tax rate. Long-term gains (from stocks held more than one year) are taxed at preferential rates of 0%, 15%, or 20%, depending on your income level. Additionally, some states impose their own capital gains taxes. Consult with a tax professional for advice specific to your situation.

What’s the difference between investing and trading?

Investing typically refers to buying and holding securities for the long term (years or decades), focusing on fundamental value and compound growth. Trading involves more frequent buying and selling, attempting to profit from shorter-term price movements. Investors might check their portfolios monthly, while traders might monitor positions daily or hourly. Both approaches can be successful, but they require different strategies, time commitments, and temperaments.

Should I use stop-loss orders for every trade?

For beginners, using stop-loss orders on every position is highly recommended. They provide automatic protection against significant losses and remove emotional decision-making during market downturns. As you gain experience, you might develop more nuanced exit strategies, but the discipline of always defining your maximum acceptable loss before entering a trade is a habit that serves even professional traders well.

How do I know if I’m ready to start trading with real money?

Consider yourself ready when: 1) You understand the basics of stock analysis and order types, 2) You’ve practiced with a paper trading account and achieved consistent results, 3) You have a written trading plan with clear entry and exit criteria, 4) You’ve set aside trading capital that you can afford to lose, and 5) You have realistic expectations about potential returns and understand the risks involved. Even then, start with smaller positions and increase size gradually as you gain experience.

,000. Remember that individual stock prices vary widely—some trade for under while others cost hundreds or thousands per share. You can start with whatever amount you’re comfortable investing, but ensure it’s money you can afford to lose.

How are stock trading gains taxed?

In the United States, stock trading profits are subject to capital gains tax. Short-term gains (from stocks held less than one year) are taxed at your ordinary income tax rate. Long-term gains (from stocks held more than one year) are taxed at preferential rates of 0%, 15%, or 20%, depending on your income level. Additionally, some states impose their own capital gains taxes. Consult with a tax professional for advice specific to your situation.

What’s the difference between investing and trading?

Investing typically refers to buying and holding securities for the long term (years or decades), focusing on fundamental value and compound growth. Trading involves more frequent buying and selling, attempting to profit from shorter-term price movements. Investors might check their portfolios monthly, while traders might monitor positions daily or hourly. Both approaches can be successful, but they require different strategies, time commitments, and temperaments.

Should I use stop-loss orders for every trade?

For beginners, using stop-loss orders on every position is highly recommended. They provide automatic protection against significant losses and remove emotional decision-making during market downturns. As you gain experience, you might develop more nuanced exit strategies, but the discipline of always defining your maximum acceptable loss before entering a trade is a habit that serves even professional traders well.

How do I know if I’m ready to start trading with real money?

Consider yourself ready when: 1) You understand the basics of stock analysis and order types, 2) You’ve practiced with a paper trading account and achieved consistent results, 3) You have a written trading plan with clear entry and exit criteria, 4) You’ve set aside trading capital that you can afford to lose, and 5) You have realistic expectations about potential returns and understand the risks involved. Even then, start with smaller positions and increase size gradually as you gain experience.