Ever missed a perfect trading opportunity because you couldn’t watch the markets all day? Conditional alerts in stock trading are your solution. These powerful tools act like your personal market assistant, monitoring price movements and notifying you when specific conditions are met. In this guide, we’ll show you how to set up these alerts across popular platforms, share real-world examples, and help you capture more trading opportunities without being glued to your screen.

What Are Conditional Alerts in Stock Trading?

Conditional alerts are automated notifications triggered when specific market conditions occur. Unlike basic price alerts that notify you when a stock hits a certain price, conditional alerts combine multiple criteria for more precise signals.

For example, instead of just alerting when a stock reaches $50, a conditional alert might notify you when a stock reaches $50 and trading volume is 50% above average. This precision helps you focus on high-probability trading setups and reduces false signals.

Why Traders Need Conditional Alerts

The markets move quickly, and opportunities don’t wait for convenient times. Conditional alerts in stock trading solve several key challenges:

- They monitor markets 24/7 so you don’t have to

- They filter out market noise by requiring multiple conditions

- They help you stick to your trading strategy by removing emotion

- They allow you to manage multiple watchlists efficiently

- They ensure you never miss critical entry or exit points

Ready to Stop Missing Trading Opportunities?

Create your first conditional alert today and start capturing the trades that matter most to your strategy.

Setting Up Conditional Alerts on Popular Trading Platforms

Let’s walk through the process of creating conditional alerts on three popular trading platforms. Each platform has its own terminology and interface, but the core concepts remain the same.

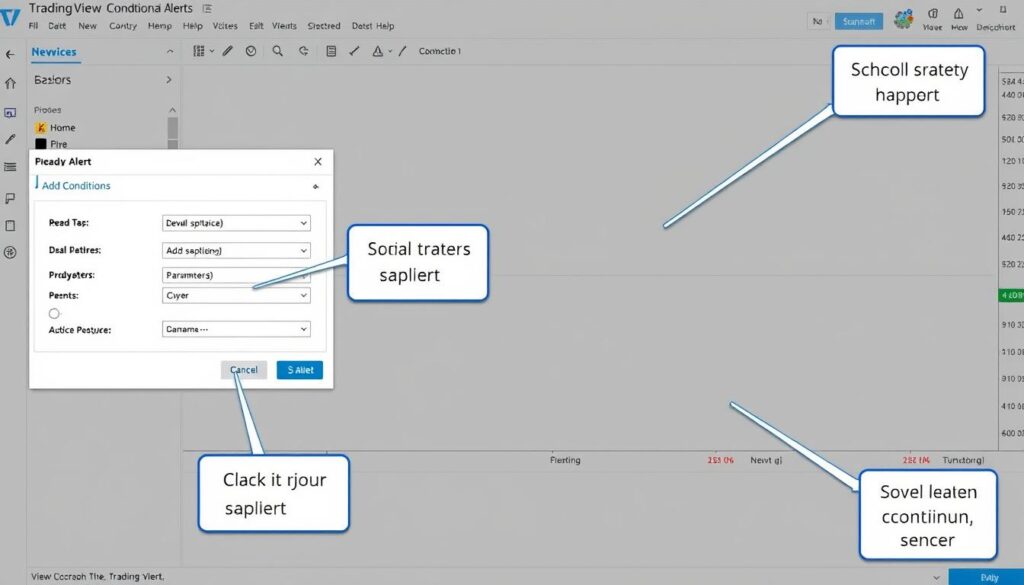

TradingView: Creating Powerful Multi-Condition Alerts

- Open the chart of the stock you want to monitor

- Right-click on the chart or click the “Alerts” button in the top toolbar

- Select “Create Alert” from the dropdown menu

- Set your primary condition (e.g., price crossing above a resistance level)

- Click “Add Condition” to set your secondary condition (e.g., volume above 1M shares)

- Configure notification settings (email, SMS, push notification)

- Name your alert and click “Create” to activate it

Pro Tip: In TradingView, you can create alerts based on custom indicators by selecting “Indicator Value” as your condition type. This allows for extremely customized alert conditions.

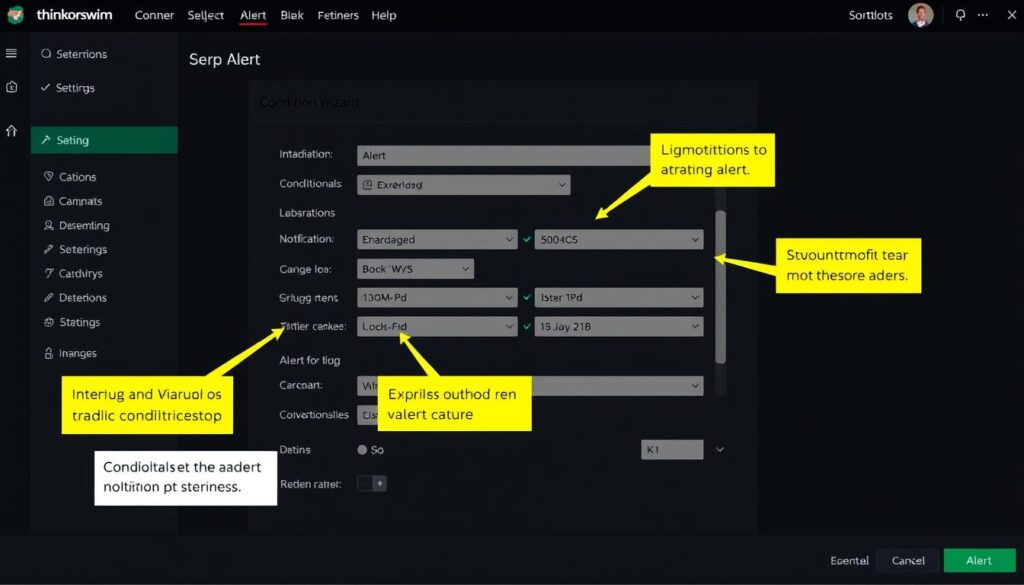

Thinkorswim: Setting Up Conditional Orders and Alerts

- Open Thinkorswim and navigate to the “MarketWatch” tab

- Select “Alerts” from the dropdown menu

- Click “Create Alert” to open the alert creation window

- Choose “Stock” as the alert type and enter your ticker symbol

- Set your primary condition using the “Condition Wizard”

- Click “Add Condition” to create a compound alert

- Configure your notification preferences and expiration settings

- Click “Create” to activate your alert

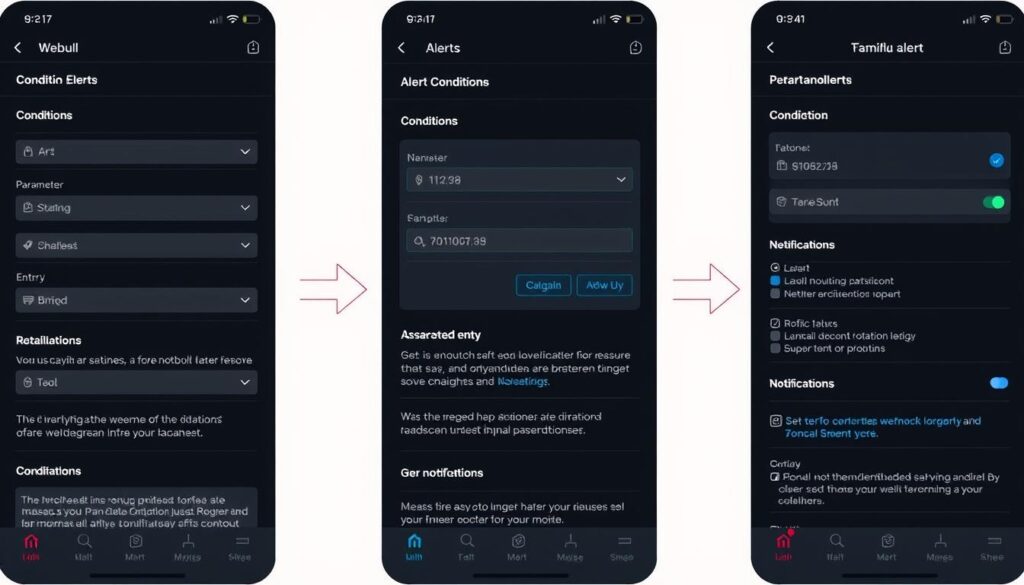

Webull: Configuring Multi-Condition Alerts

- Open the Webull app and navigate to your watchlist

- Tap on the stock you want to create an alert for

- Tap the “Alert” icon (bell symbol) in the upper right corner

- Select “Create New Alert” from the menu

- Choose your primary condition (price, technical indicator, etc.)

- Tap “Add Condition” to set additional criteria

- Configure notification settings and alert duration

- Tap “Create” to activate your alert

Note: Webull’s free version limits the number of conditional alerts you can create. Consider upgrading to Webull Pro for unlimited alerts if you’re an active trader.

Real-World Examples of Conditional Alerts in Stock Trading

Let’s explore three practical examples of conditional alerts that can help you capture specific trading opportunities.

Example 1: Breakout with Volume Confirmation

This powerful setup alerts you when a stock breaks through a key resistance level with strong volume confirmation, reducing false breakouts.

Breakout Alert Setup:

- Primary condition: Price crosses above resistance level (e.g., $75.50)

- Secondary condition: Volume is at least 50% higher than 20-day average volume

- Alert frequency: Once per bar close

- Notification type: Push notification and email

Example 2: Oversold RSI with Support Level Test

This alert helps you identify potential buying opportunities when a stock is oversold and testing a key support level.

Oversold Bounce Alert Setup:

- Primary condition: RSI(14) crosses below 30 (oversold)

- Secondary condition: Price is within 2% of major support level

- Alert frequency: Once per day

- Notification type: SMS and platform notification

Example 3: Moving Average Crossover with Trend Confirmation

This classic “Golden Cross” alert is enhanced with a trend confirmation condition to filter out false signals in choppy markets.

Golden Cross Alert Setup:

- Primary condition: 50-day MA crosses above 200-day MA

- Secondary condition: Price is above both moving averages

- Alert frequency: Once per crossover

- Notification type: Email with screenshot

Want More Powerful Alert Strategies?

Download our free guide with 10 advanced conditional alert setups used by professional traders.

How Conditional Alerts Improve Trading Efficiency

The true power of conditional alerts in stock trading lies in how they transform your trading workflow and efficiency. Let’s examine the tangible benefits:

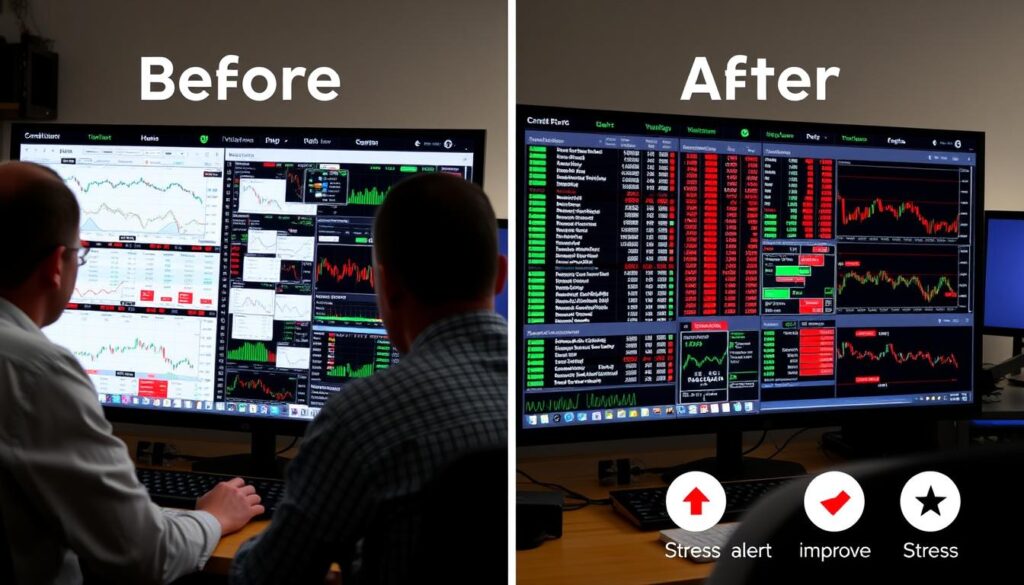

Freedom from Constant Monitoring

Without alerts, traders often find themselves glued to screens for hours, afraid to miss key movements. Conditional alerts free you from this constraint, allowing you to:

- Focus on analysis rather than monitoring

- Trade part-time while maintaining other responsibilities

- Reduce screen fatigue and mental exhaustion

- Capture opportunities in multiple time zones

Comparison: Manual Monitoring vs. Conditional Alerts

| Aspect | Manual Monitoring | Using Conditional Alerts |

| Time Investment | 4-8 hours daily of active watching | 30-60 minutes daily for setup and review |

| Coverage | Limited to 5-10 stocks at once | Can monitor 50+ stocks simultaneously |

| Emotional Impact | High stress, prone to emotional decisions | Reduced stress, more objective decisions |

| Opportunity Cost | Sacrifices other activities and opportunities | Freedom to pursue other activities |

| Consistency | Varies with attention and fatigue | Consistent 24/7 monitoring |

Reducing Decision Fatigue

Every trading day presents hundreds of potential decisions. Conditional alerts in stock trading help reduce decision fatigue by:

- Filtering out low-probability setups

- Presenting only opportunities that match your strategy

- Reducing the temptation to overtrade

- Creating a systematic approach to market analysis

Practical Tips for Effective Alert Management

Setting up conditional alerts is just the beginning. Here’s how to manage them effectively for maximum trading success.

Best Practices

- Start with 3-5 well-defined alerts before expanding

- Test alerts in a demo account before using real money

- Review and refine alert conditions regularly

- Use different notification methods for different priority alerts

- Document which alerts lead to successful trades

Common Mistakes

- Setting too many alerts causing “alert fatigue”

- Creating conditions that are too specific and rarely trigger

- Ignoring alerts or not having a plan when they trigger

- Not testing alerts before relying on them

- Setting the same alert conditions for all market environments

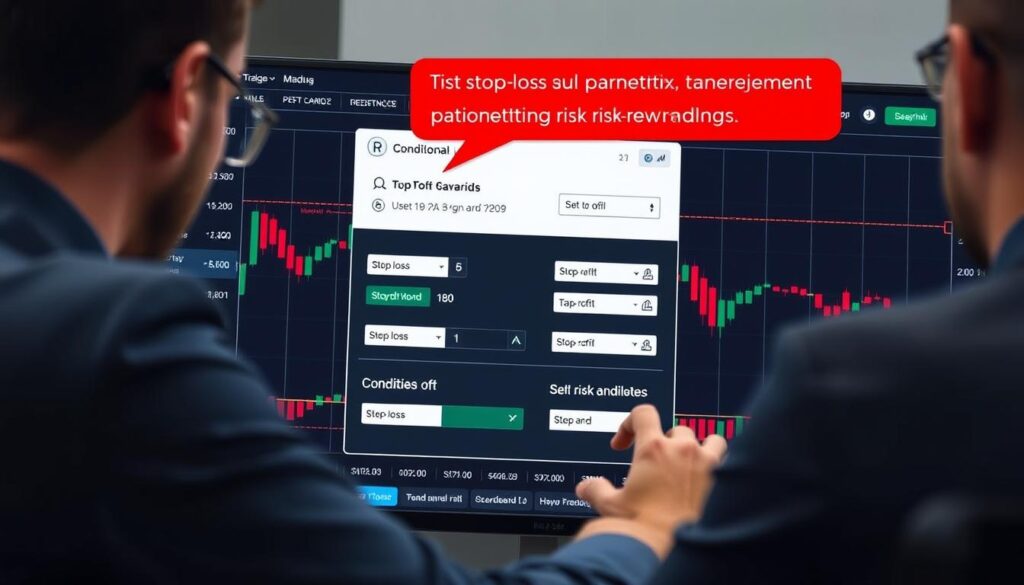

Combining Alerts with Risk Management

Conditional alerts should be integrated with your risk management strategy:

- Pre-determine position sizes for each alert type

- Set stop-loss levels before acting on any alert

- Create alert-specific trading plans with entry, exit, and risk parameters

- Use time-based filters to avoid trading during volatile market openings

- Consider market context before acting on any alert

Important: Never trade automatically based solely on alerts without confirming the setup. Alerts are tools to direct your attention, not replacement for analysis.

Adjusting Alerts for Different Market Conditions

Market conditions change, and your alerts should adapt accordingly:

| Market Condition | Alert Adjustment |

| High Volatility | Widen price thresholds, add volume filters |

| Low Volatility | Tighten price thresholds, focus on breakout patterns |

| Strong Trend | Use pullback alerts to established trend |

| Choppy/Sideways | Focus on range-bound strategies, support/resistance tests |

| Earnings Season | Add earnings date filters, increase volume thresholds |

Frequently Asked Questions About Conditional Alerts

How many conditional alerts should I set up?

Start with 3-5 well-defined alerts that align with your trading strategy. Too many alerts can lead to “alert fatigue” where you begin ignoring notifications. As you become more comfortable, you can gradually expand your alert system.

Do I need a paid subscription to use conditional alerts?

Basic alerts are available on most free platform versions, but conditional alerts with multiple criteria often require a premium subscription. However, the time saved and opportunities captured typically outweigh the subscription cost for active traders.

Can conditional alerts work for any trading style?

Yes, conditional alerts in stock trading can be customized for any trading style. Day traders might set alerts for intraday patterns with volume confirmation, while swing traders could focus on daily chart patterns with momentum indicators as secondary conditions.

What’s the difference between alerts and automated trading?

Alerts notify you of conditions but require manual action to execute trades. Automated trading systems execute trades automatically when conditions are met without human intervention. Alerts give you the final decision-making power before committing capital.

How do I know if my conditional alerts are effective?

Track your alerts in a trading journal. Record which alerts you acted on, the resulting trades, and their outcomes. Over time, you’ll identify which alert conditions lead to profitable trades and which need refinement.

Ready to Transform Your Trading Experience?

Join our community of traders who use conditional alerts to capture opportunities while maintaining work-life balance.

Conclusion: Taking Action with Conditional Alerts

Conditional alerts in stock trading represent one of the most powerful tools available to modern traders. They transform how you interact with the markets, allowing you to:

- Monitor more opportunities without increasing screen time

- Focus on high-probability setups that match your strategy

- Trade more systematically and less emotionally

- Maintain a healthy work-life balance while staying active in the markets

The key to success with conditional alerts is starting simple, testing thoroughly, and gradually refining your approach. Begin with the examples we’ve shared, adapt them to your trading style, and track your results. With practice, you’ll develop a personalized alert system that helps you consistently capture the trading opportunities that matter most to your strategy.

Remember that alerts are tools to direct your attention, not replace your analysis. The most successful traders use alerts to know when to look, but still apply their judgment before taking action. Start implementing conditional alerts today, and you’ll quickly see how they can transform your trading efficiency and results.