You’ve been there before. That stock you’ve been watching for weeks suddenly breaks out while you’re in a meeting. By the time you check your portfolio, the opportunity is gone. Or worse, a position tanks while you’re away from your screen, and you miss the chance to cut your losses. In today’s fast-moving markets, timing isn’t just important—it’s everything.

What if you could have eyes on the market 24/7 without being glued to your screen? The right stock alert app can be the difference between capturing perfect entry and exit points or constantly playing catch-up. This guide will show you how to transform your trading precision and potentially boost your results with real-time notifications that matter.

The Hidden Cost of Missed Trading Opportunities

According to a recent trading behavior study, the average active trader misses approximately 5-7 potential opportunities weekly due to timing issues. These missed trades aren’t just frustrating—they’re expensive. For someone trading just 10 times monthly, this could mean missing over 60% of optimal entry and exit points.

The financial impact is substantial. Consider a modest $10,000 portfolio where just three missed opportunities at 2% each represents $600 in unrealized gains monthly—or over $7,000 annually. For more active traders with larger portfolios, these numbers multiply dramatically.

Reality Check: 68% of retail traders report that poor timing—not poor strategy—is their biggest obstacle to consistent results. The market moves whether you’re watching or not.

Why Manual Monitoring Fails Even Dedicated Traders

Even if you could watch the markets all day, human attention has limits. Studies show that after 20 minutes of chart watching, pattern recognition abilities decline by up to 30%. Add in life’s inevitable distractions—meetings, family obligations, sleep—and it’s physically impossible to catch every move.

The psychological toll is equally damaging. The constant fear of missing out creates anxiety that leads to poor decision-making. You either become paralyzed (missing opportunities) or impulsive (entering trades prematurely). Neither produces consistent results.

Stop Missing Critical Market Moves

Get alerts for price breakouts, volume spikes, and technical patterns—delivered instantly to your phone or desktop.

How Stock Alert Apps Transform Your Trading Precision

Stock alert apps serve as your personal market monitor, working tirelessly to notify you when specific conditions are met. Unlike manual monitoring, these tools never sleep, never get distracted, and never miss a signal that matches your criteria.

Key Features That Make Stock Alert Apps Essential

- Real-time price alerts that notify you instantly when stocks hit your target levels, whether you’re watching the market or not

- Technical indicator notifications that trigger when patterns form or indicators cross (like RSI, MACD, or moving averages)

- Volume spike detection to identify unusual activity that often precedes major price movements

- Multi-asset coverage across stocks, ETFs, cryptocurrencies, and forex markets from a single dashboard

- Custom delivery options via push notifications, email, SMS, or even phone calls for critical alerts

The Transformation: Manual vs. Alert-Driven Trading

| Trading Aspect | Without Alerts | With Stock Alert App |

| Opportunity Capture | Miss 60-70% of optimal entries/exits | Capture 85-95% of planned opportunities |

| Reaction Time | Minutes to hours (if noticed at all) | Seconds to minutes |

| Emotional Trading | High (FOMO, panic selling) | Reduced (systematic approach) |

| Time Investment | 4-8+ hours daily watching charts | 30-60 minutes setting/reviewing alerts |

| Strategy Execution | Inconsistent, often compromised | Consistent, follows predetermined plan |

Real Results: A Trader’s Perspective

“I was missing at least 3-4 good setups weekly because I couldn’t watch the market during my day job. After setting up custom alerts for my favorite technical patterns, I’m catching about 85% of my planned trades. My win rate hasn’t changed dramatically, but my overall returns increased by 22% in just three months simply because I’m actually in the trades I planned.”

— Michael T., Options Trader

Trade on Your Terms, Not the Market’s Schedule

Set up personalized alerts and let the opportunities come to you—no more constant chart watching.

The 5 Best Stock Alert Apps for Active Traders in 2025

After testing dozens of platforms and analyzing thousands of user reviews, we’ve identified the top stock alert applications that deliver the best combination of reliability, customization, and value. Each serves different trading styles and needs.

1. TradingView: Best Overall for Technical Traders

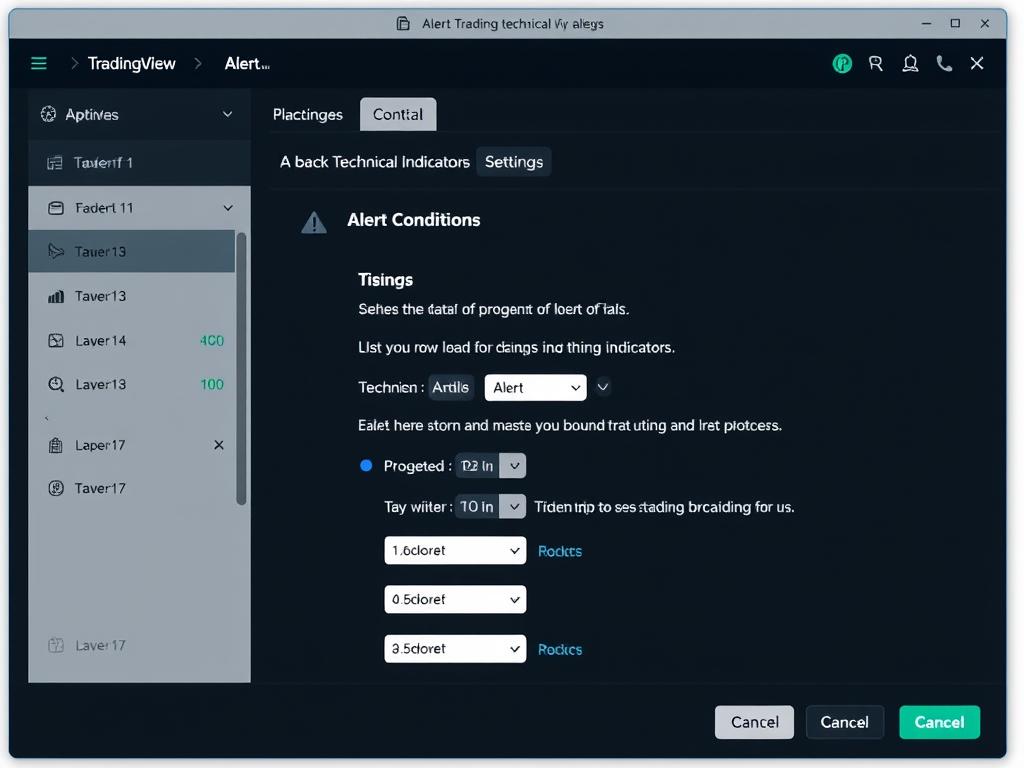

TradingView stands out as the most comprehensive platform for technical traders who need powerful charting combined with flexible alerts. With support for over 100 technical indicators and custom scripts, you can create alerts for virtually any market condition.

The platform allows you to set notifications based on price levels, indicator crossovers, drawing tool interactions (like trendline breaks), and even custom formulas. Alerts can be delivered via email, SMS, or push notifications to ensure you never miss a trading opportunity.

Key Features:

- Advanced charting with 100+ built-in indicators

- Custom alert conditions using Pine Script

- Multi-asset coverage (stocks, crypto, forex, futures)

- Social community for sharing trading ideas

- Cross-platform sync (desktop, web, mobile)

Pros

- Most powerful technical analysis tools

- Highly customizable alerts

- Excellent mobile app experience

- Strong community for learning

- Generous free tier available

Cons

- Learning curve for advanced features

- Limited alerts on free plan

- Premium features require subscription

Pricing: Free plan available; Premium plans from $14.95/month

Exclusive Offer for Our Readers

Get a $15 credit toward your first premium subscription when you sign up through our link.

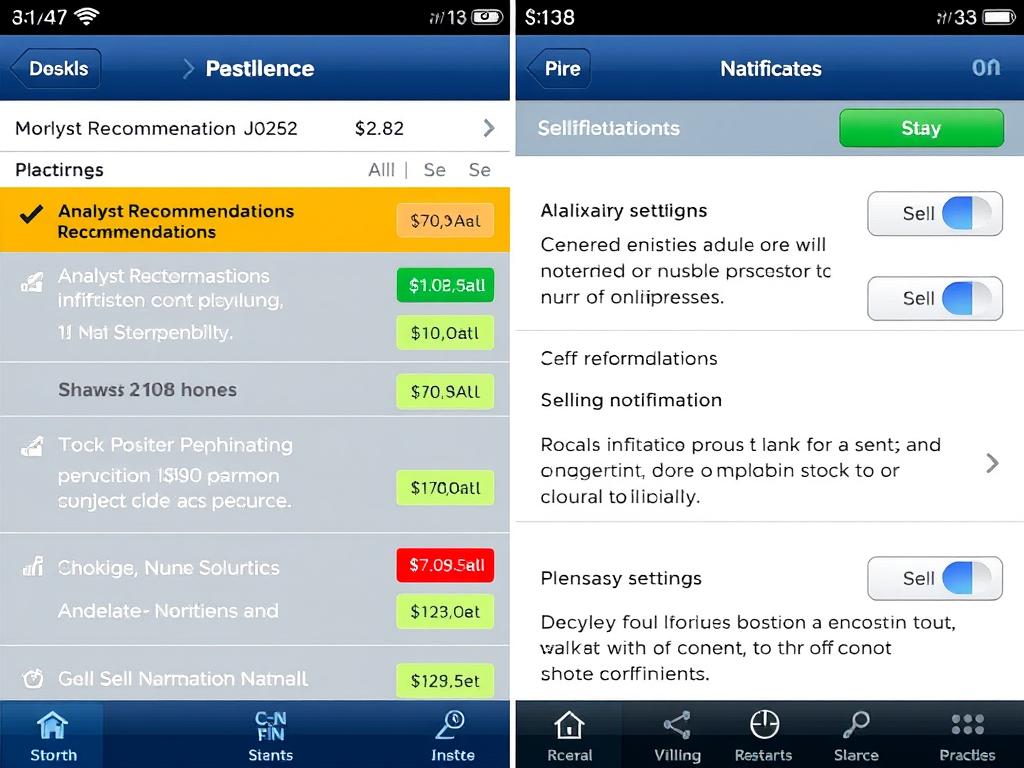

2. Stock Alarm: Best for Multi-Channel Alerts

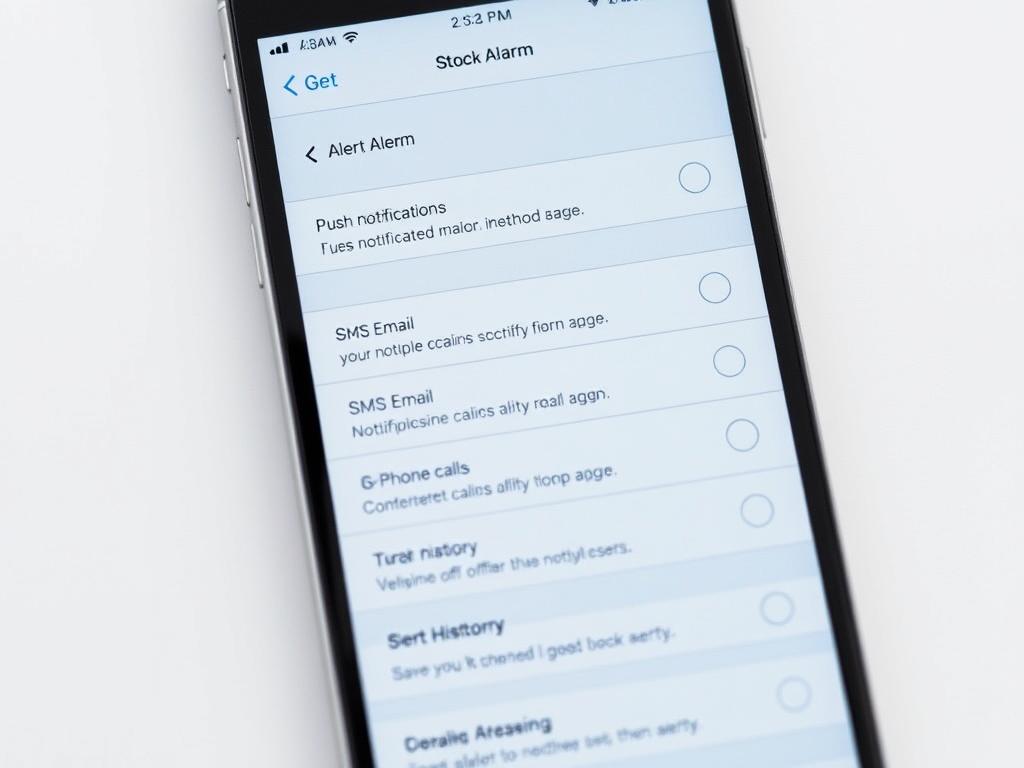

Stock Alarm specializes in reliable alert delivery across multiple channels. What sets it apart is the ability to receive notifications via push alerts, SMS, email, or even phone calls for critical price movements. This ensures you never miss an important market event, even when away from your trading desk.

The app monitors over 65,000 assets including stocks, ETFs, cryptocurrencies, and forex pairs. With support for extended hours trading and international markets, it’s ideal for traders who need comprehensive coverage across different asset classes.

Pros

- Multiple notification channels (calls, SMS, push)

- Extensive market coverage

- Support for extended hours trading

- User-friendly mobile interface

Cons

- Limited technical analysis tools

- No free plan after trial period

- Fewer customization options than TradingView

Pricing: 7-day free trial; Plans from $9.99/month

3. Benzinga Pro: Best for News-Driven Traders

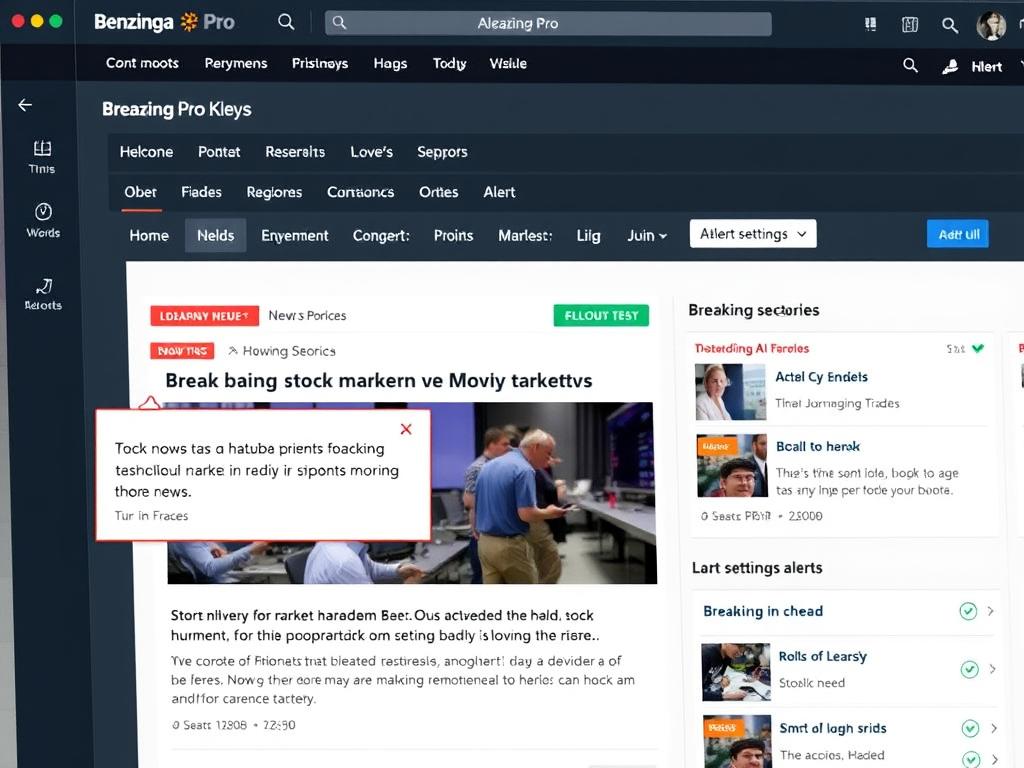

Benzinga Pro excels at delivering market-moving news before it impacts stock prices. Its real-time news feed, audio squawk for breaking stories, and customizable alerts for specific companies make it invaluable for traders who rely on news catalysts for their strategies.

The platform provides instant notifications for earnings announcements, FDA approvals, analyst upgrades/downgrades, and other market-moving events. While it comes at a premium price point, the speed and quality of information can provide a significant edge for news-driven traders.

Pros

- Fastest delivery of market-moving news

- Audio squawk for hands-free updates

- SEC filing and insider trading alerts

- Customizable workspaces

Cons

- Premium pricing (starts at $99/month)

- Limited technical analysis tools

- Steep learning curve for all features

Pricing: Plans start at $37/month with annual commitment

4. Yahoo Finance: Best Free Option

Yahoo Finance offers a surprisingly robust free alert system that covers the essentials for casual investors. Users can create watchlists and receive notifications for price movements, earnings announcements, and major news stories without spending a dime.

While it lacks the advanced customization of premium platforms, Yahoo Finance provides excellent coverage of stocks, ETFs, and cryptocurrencies with a user-friendly interface. The premium tier (Yahoo Finance Plus) adds additional features like advanced charting and research reports.

Pros

- Completely free basic plan

- User-friendly interface

- Good integration of news and alerts

- Comprehensive market coverage

Cons

- Limited alert customization

- Basic technical analysis tools

- Occasional performance issues

Pricing: Free; Yahoo Finance Plus from $7.95/month

5. Motley Fool Stock Advisor: Best for Long-Term Investors

While not a traditional alert app, Motley Fool Stock Advisor provides notification-based investing guidance for long-term investors. Subscribers receive alerts when new stock recommendations are released or when there are important updates to existing picks.

The service focuses on fundamental analysis and long-term growth potential rather than short-term price movements. For investors who prefer research-backed recommendations over technical signals, this approach offers value without the need for constant monitoring.

Pros

- Research-backed stock recommendations

- Focus on long-term growth

- Educational content included

- Transparent performance tracking

Cons

- Not for active traders

- Limited technical alerts

- Higher price point ($199/year)

Pricing: $199/year (introductory offers available)

Why TradingView Stands Above the Rest

For the perfect balance of powerful alerts, technical analysis, and value, TradingView delivers what serious traders need.

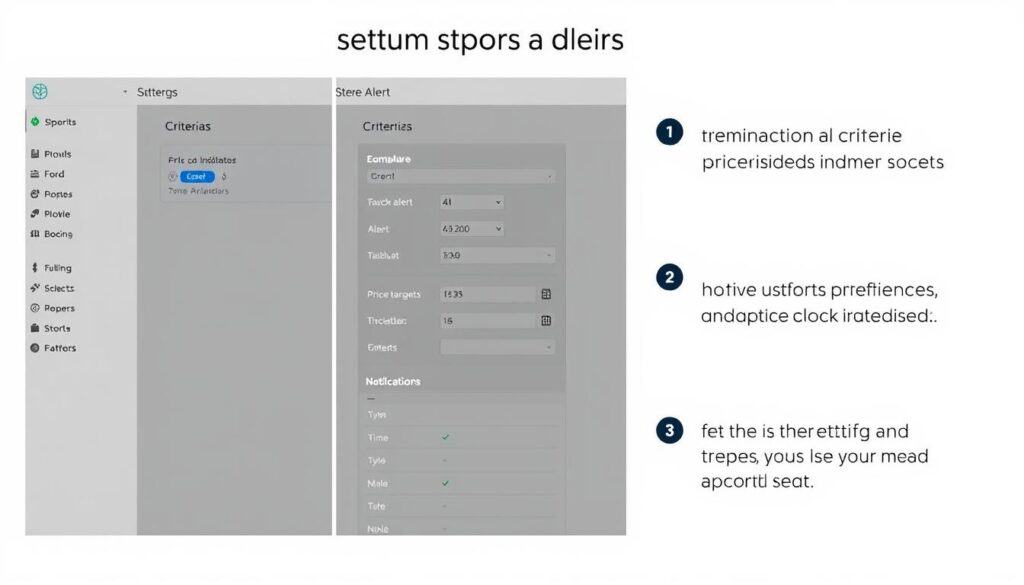

3 Steps to Set Up Effective Stock Alerts

The power of any stock alert app depends on how effectively you configure it. Follow these three steps to create alerts that capture meaningful opportunities while filtering out market noise.

-

Define Your Trading Criteria

Start by identifying exactly what market conditions matter for your strategy. This could be price targets, technical indicator readings, volume thresholds, or news events. Be specific about what constitutes an actionable signal versus normal market noise.

Example: Instead of a simple “price above $50” alert, consider “price breaks above $50 with volume at least 50% above 20-day average.”

-

Set Up Layered Alert Systems

Create a hierarchy of alerts with different urgency levels. Use multiple conditions to filter for higher-probability setups, and assign different notification methods based on importance.

Example: Use push notifications for preliminary signals, but trigger SMS or calls only for your highest-conviction setups that require immediate action.

-

Test and Refine Your Alerts

Monitor how your alerts perform over time. Are you receiving too many false signals? Not enough actionable notifications? Regularly adjust your parameters to improve signal quality and reduce noise.

Example: If RSI crossing below 30 generates too many alerts in choppy markets, add a condition requiring the price to be below a moving average to confirm the downtrend.

Pro Tip: Most traders find that 5-10 well-configured alerts are more valuable than dozens of basic ones. Focus on quality over quantity to avoid alert fatigue.

Alert Types Worth Setting Up

Price-Based Alerts

- Support/resistance breaks

- 52-week highs/lows

- Gap fills

- Price channels

Technical Indicator Alerts

- Moving average crossovers

- RSI overbought/oversold

- MACD signal line crosses

- Bollinger Band squeezes

Volume & Volatility Alerts

- Unusual volume spikes

- Declining volume on rallies

- Volatility expansions

- Options volume surges

Start Creating Your Custom Alerts Today

TradingView offers the most flexible alert system for technical traders—with our exclusive $15 credit offer.

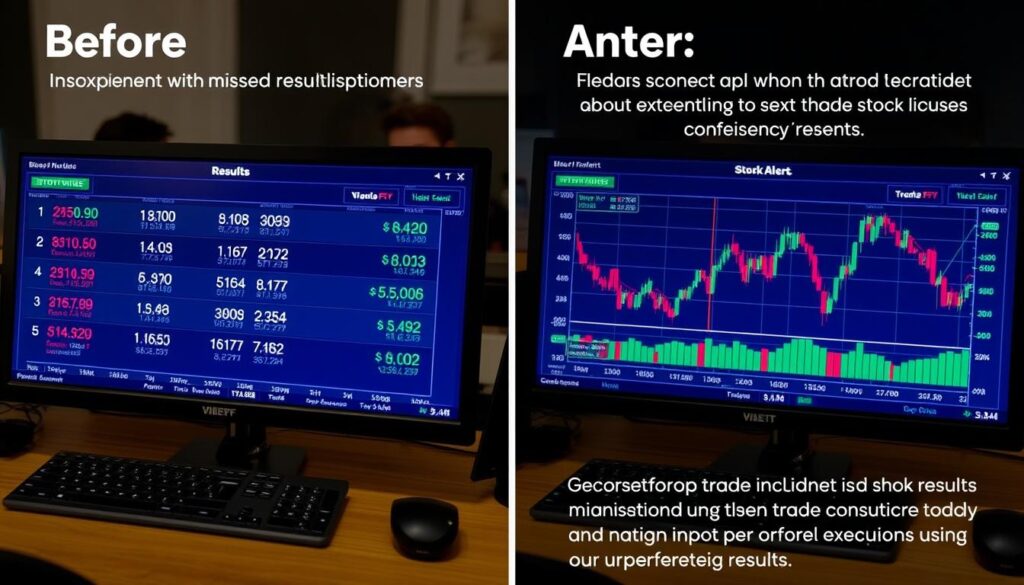

Real Results: How Stock Alerts Transformed My Trading

“Before implementing a proper alert system, I was catching maybe 40% of my planned trades. I’d identify setups the night before, but during market hours, I’d miss the exact entry points while handling other responsibilities. My trading journal showed a frustrating pattern of ‘identified but not executed’ opportunities.

After setting up custom alerts in TradingView, I’m executing on nearly 90% of my planned trades. The difference has been dramatic—not just in returns, but in reduced stress. I no longer feel chained to my trading screen, constantly worried about missing moves.

The most valuable alerts for me have been the multi-condition technical triggers. For example, I set alerts for when RSI crosses below 30 while price tests a major support level on higher-than-average volume. These precise conditions filter out noise and highlight only the highest-probability setups.”

— James K., Day Trader

My Before & After Results

| Performance Metric | Before Alerts | After Alerts | Improvement |

| Planned Trades Executed | 42% | 89% | +47% |

| Average Monthly Return | 1.8% | 3.2% | +1.4% |

| Win Rate | 52% | 58% | +6% |

| Hours Spent Monitoring | 6-7 daily | 1-2 daily | -5 hours |

| Trading Stress Level | High | Low | Significant |

Disclaimer: Past performance is not indicative of future results. Individual trading results will vary based on strategy, market conditions, and personal execution. The example above represents one trader’s experience and should not be considered typical or expected.

Special Offer: Upgrade Your Trading with TradingView

After reviewing dozens of stock alert applications, TradingView consistently stands out for its combination of powerful technical analysis tools, flexible alert system, and excellent value. It’s the platform I personally use and recommend to fellow traders.

Exclusive Reader Offer: Get a $15 credit toward your first premium subscription when you sign up through our link. This offer is available for a limited time only.

Why Choose TradingView Premium?

- Unlimited alerts across all your devices (vs. just 1 alert on the free plan)

- Server-side alerts that work even when your app is closed

- Advanced alert conditions using multiple indicators and custom scripts

- Priority alert delivery for faster notification during market volatility

- Extended data coverage for global markets and assets

- Multiple chart layouts for different trading strategies

- Enhanced mobile experience with full alert functionality

- No advertisements for distraction-free analysis

- Priority customer support when you need assistance

- Volume profile and advanced indicators for deeper analysis

Plans and Pricing

- 1 active alert

- Basic indicators

- 1 chart per tab

- Limited watchlists

- Community access

- Price: $0

Basic (Free)

- Unlimited alerts

- 100+ indicators

- 4 charts per tab

- Multiple watchlists

- Priority support

- Price: $14.95/mo

Pro (Recommended)

- Unlimited alerts

- 100+ indicators

- 8 charts per tab

- Second-based intervals

- Premium support

- Price: $29.95/mo

Pro+

Claim Your $15 Credit Today

Try TradingView Premium risk-free with our exclusive offer. 30-day money-back guarantee included.

Frequently Asked Questions About Stock Alert Apps

Are stock alert apps suitable for cryptocurrency trading?

Yes, many stock alert apps including TradingView and Stock Alarm support cryptocurrency alerts. TradingView covers all major cryptocurrencies and many altcoins, allowing you to set alerts based on price movements and technical indicators. The same principles apply—you can create alerts for support/resistance breaks, volume spikes, or indicator crossovers on crypto assets just as you would with stocks.

How reliable are the notifications? Will I miss alerts if my phone is off?

Alert reliability varies by platform. Premium services like TradingView and Stock Alarm use server-side processing, meaning alerts trigger even if your device is off. When your device reconnects, you’ll receive pending notifications. For critical alerts, consider setting up multiple delivery methods (email, push notification, SMS) to ensure you don’t miss important signals. TradingView’s Pro plan includes server-side alerts that work 24/7 regardless of your device status.

Can I trade directly from these alert apps?

Most alert apps don’t offer direct trading capabilities. TradingView does provide broker integration with select partners, allowing you to execute trades directly from charts after receiving an alert. However, the primary purpose of these apps is to notify you of opportunities—you’ll typically need to use your brokerage platform to place actual trades. This separation can actually be beneficial, creating a moment for conscious decision-making rather than impulsive trading.

Is the credit offer available for all subscription plans?

Yes, our exclusive credit can be applied to any TradingView paid subscription plan. It’s automatically applied when you sign up through our affiliate link. The credit reduces the cost of your first billing cycle. This offer is available for new TradingView premium subscribers only and cannot be combined with other promotions. All plans come with a 30-day money-back guarantee, allowing you to try the premium features risk-free.

Will stock alerts guarantee better trading results?

No tool can guarantee trading success. Stock alerts are designed to improve your timing and execution by notifying you of potential opportunities based on your predefined criteria. However, the quality of your trading strategy, risk management, and decision-making remain crucial factors. Alerts help you execute your existing strategy more consistently—they don’t create a winning strategy on their own. Many traders report improved results after implementing alerts, primarily because they execute their planned trades more consistently rather than missing opportunities.

Take Control of Your Trading with Real-Time Stock Alerts

In today’s fast-moving markets, the difference between consistent profits and missed opportunities often comes down to timing and execution. Stock alert apps provide the technological edge needed to monitor markets 24/7 without being chained to your screen.

Whether you’re a day trader needing split-second notifications, a swing trader looking to catch breakouts, or a long-term investor wanting to stay informed about your holdings, the right alert system can transform your trading experience. You’ll catch more opportunities, reduce emotional decision-making, and reclaim hours of your day previously spent watching charts.

TradingView stands out as our top recommendation for its powerful combination of technical analysis tools, flexible alert system, and excellent value. With our exclusive $15 credit offer, there’s never been a better time to upgrade your trading toolkit.

Risk Disclosure: Trading stocks, options, and other financial instruments involves risk. Past performance is not indicative of future results. The information provided is for educational purposes only and should not be considered financial advice. Always do your own research and consider your financial situation before making investment decisions.

Affiliate Disclosure: We may receive a commission when you sign up for TradingView through our affiliate link. This comes at no additional cost to you and helps support our content. We only recommend products we personally use and believe provide value to our readers.

Never Miss Another Trading Opportunity

Try TradingView Premium with our exclusive $15 credit and 30-day money-back guarantee.