When it comes to investing, most people focus heavily on strategies, techniques, and market timing. But here’s what separates truly exceptional investors from the rest: it’s not just what they do, but how they think. The successful investors mindset operates on a different level—one that allows them to see opportunities where others see threats, remain calm when markets panic, and make rational decisions when emotions run high.

I’ve spent years studying the mental frameworks that drive investment success, and I’ve discovered that mindset matters more than method. While strategy is important, it’s your mental approach that determines whether you’ll stick with that strategy through market turbulence or abandon it at the worst possible moment.

The successful investor’s approach combines analytical thinking with emotional discipline

Strategy vs. Mindset: The Critical Difference

Most investment education focuses on what to buy, when to buy it, and when to sell. These strategy-focused approaches treat investing as a purely technical exercise. But experienced investors know better. Warren Buffett himself said that “investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ… what’s needed is a sound intellectual framework for making decisions.”

Strategy-focused investing relies on finding the perfect technique. Mindset-focused investing recognizes that even the best strategy fails without the right mental framework to execute it properly. Let me show you the difference:

Strategy-Focused Approach

- Searches for the “perfect” investment method

- Frequently changes tactics based on recent results

- Reacts emotionally to market movements

- Focuses primarily on short-term outcomes

- Sees investing as a series of transactions

Mindset-Focused Approach

- Develops consistent decision-making principles

- Maintains steady approach through market cycles

- Responds rationally to market movements

- Prioritizes long-term compounding

- Sees investing as a continuous process

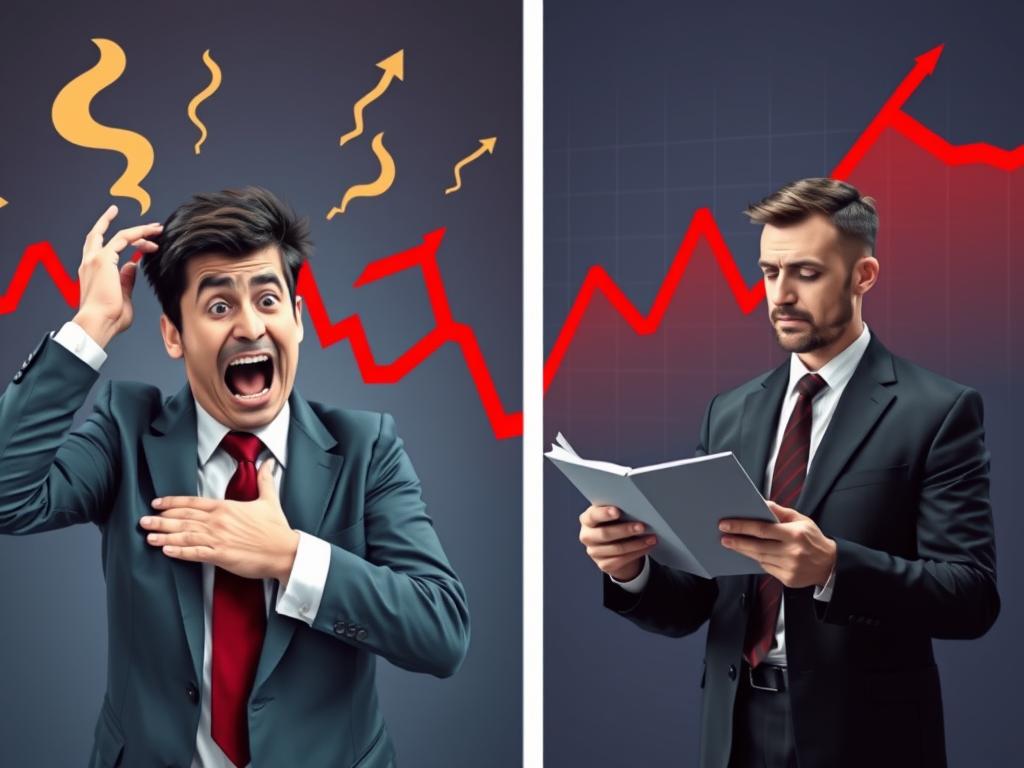

The difference becomes most apparent during market extremes. When markets plunge, strategy-focused investors often panic and sell at the worst possible time. Mindset-focused investors see the same drop as an opportunity and maintain their discipline.

How different mindsets respond to market volatility

5 Key Mental Frameworks of Successful Investors

After studying the habits and thought processes of exceptional investors, I’ve identified five critical mental frameworks that consistently appear across different investment styles. These aren’t just nice ideas—they’re practical thinking tools that reshape how you approach every investment decision.

1. Long-Term Thinking

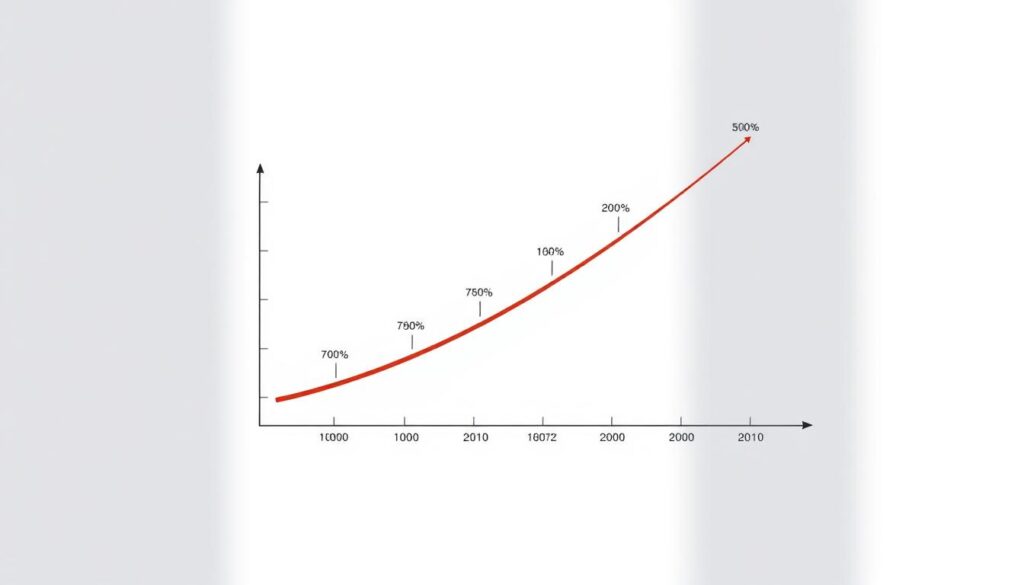

Charlie Munger famously said, “The big money is not in the buying and selling, but in the waiting.” Successful investors think in decades, not days. They understand that compounding requires time and patience to work its magic.

This mindset allows them to ignore short-term market noise and focus on fundamental value. When everyone else is panicking about quarterly results, they’re thinking about where a company will be in ten years. This perspective gives them a tremendous advantage.

“The stock market is designed to transfer money from the active to the patient.” – Warren Buffett

The power of compounding: Patient investors reap exponentially greater rewards

2. Probabilistic Reasoning

Amateur investors think in absolutes: “This stock will go up” or “That market will crash.” Successful investors think in probabilities. They ask: “What’s the range of possible outcomes, and how likely is each one?”

This framework helps them manage risk more effectively. Instead of trying to predict exactly what will happen (impossible), they prepare for multiple scenarios and position themselves to benefit regardless of which one unfolds.

When making investment decisions, they consider both the potential upside and the likelihood of that upside occurring. This balanced approach prevents both excessive optimism and paralyzing fear.

3. Risk Management Focus

The most successful investors are obsessed with not losing money. As Buffett’s first rule states: “Never lose money.” His second rule? “Never forget rule number one.”

This doesn’t mean they avoid risk—it means they’re extremely thoughtful about which risks they take. They understand that protecting capital is just as important as growing it. By focusing first on what could go wrong, they ensure their survival through difficult markets.

Key Insight: Successful investors understand that avoiding major losses is more important than maximizing gains. A 50% loss requires a 100% gain just to break even.

4. Independent Thinking

The market is driven by collective psychology, often leading to irrational extremes of fear and greed. Successful investors develop the ability to think independently and avoid the herd mentality.

This doesn’t mean contrarianism for its own sake. Rather, it means doing your own analysis and having the courage to act on it, even when it differs from popular opinion. Some of the greatest investment opportunities arise when quality assets are abandoned by the crowd.

Independent thinking often means standing apart from the crowd

5. Continuous Learning Orientation

Markets evolve constantly, and no investment approach works forever. The most successful investors maintain a growth mindset—they’re always learning, adapting, and refining their understanding.

This learning orientation extends beyond just financial knowledge. They study psychology to understand market behavior, history to recognize patterns, and even fields like biology and physics for mental models that apply to investing.

Ray Dalio, founder of Bridgewater Associates, attributes much of his success to this approach: “I’m a very curious person. I want to understand how everything works—not just investing, but everything.”

3 Daily Habits That Reinforce Investor Discipline

Mindsets aren’t just abstract concepts—they’re reinforced through daily practices. Here are three specific habits that successful investors use to maintain discipline and strengthen their mental frameworks:

1. Deliberate Information Consumption

Successful investors are extremely intentional about what information they consume. They focus on high-quality, long-form content rather than reactive news headlines or market predictions.

For example, instead of checking stock prices multiple times daily (which encourages short-term thinking), they might review their portfolio just once a month. Instead of watching financial TV, they read annual reports and industry analyses.

Practical Example: Howard Marks, co-founder of Oaktree Capital Management, spends hours each day reading research reports, financial statements, and academic papers—but rarely watches financial news channels.

This selective information diet helps maintain perspective and prevents emotional reactions to market noise. It’s not about ignoring information, but about prioritizing signal over noise.

2. Decision Journaling

Many top investors maintain detailed records of their investment decisions—not just what they bought or sold, but why they made those choices. This practice creates accountability and helps identify patterns in their thinking.

A decision journal typically includes the investment thesis, expected outcomes, potential risks, and the investor’s emotional state at the time of decision. Reviewing these entries later provides invaluable feedback on both process and results.

A decision journal helps track both investment logic and emotional factors

3. Regular Portfolio Review with Fixed Rules

Successful investors establish clear rules for when and how they’ll review their portfolios. This might be quarterly or semi-annually, with specific criteria for making changes.

These predetermined rules prevent emotional decision-making during market volatility. For example, an investor might decide in advance that they’ll rebalance their portfolio if allocations drift more than 5% from targets—regardless of market conditions or their feelings at the time.

This habit creates a structured process that reinforces discipline and removes the emotional component from investment decisions.

Decision-Making Principles for Any Market

The true test of an investor’s mindset comes during market extremes. Here’s how successful investors adapt their thinking in both bull and bear markets while maintaining their core principles.

Bull Market Principles

When markets are rising and optimism abounds, successful investors become more cautious, not more aggressive. They understand that enthusiasm often leads to overvaluation and increased risk.

- Maintain valuation discipline – Don’t abandon price sensitivity just because markets are rising

- Question your assumptions – Ask what could go wrong with your most successful investments

- Take some profits – Trim positions that have grown disproportionately large

- Prepare for the inevitable downturn – Build cash reserves for future opportunities

Maintaining discipline when everyone else is euphoric

Bear Market Principles

During market downturns, when fear dominates, successful investors become more opportunistic. They recognize that panic often creates significant mispricings and opportunities.

- Focus on fundamentals, not prices – Evaluate businesses based on long-term value, not recent price action

- Increase research efforts – Look for quality assets being sold indiscriminately

- Deploy capital gradually – Invest in tranches rather than all at once

- Remember your time horizon – Short-term volatility matters little for long-term investors

“Be fearful when others are greedy, and greedy when others are fearful.” – Warren Buffett

The key insight here is that successful investors don’t change their fundamental approach based on market conditions—they apply the same principles consistently but adjust their specific actions to the environment.

Developing Your Investor Mindset: Actionable Steps

Transforming your investment thinking doesn’t happen overnight, but these practical steps can accelerate your progress toward developing a successful investor’s mindset:

1. Create Your Investment Philosophy Document

Write down your core investment beliefs, time horizon, risk tolerance, and decision-making criteria. This document serves as your personal investment constitution—something you can refer to during market turbulence to stay grounded.

Review and refine this document periodically, but don’t change it in response to short-term market movements. It should evolve with your knowledge and experience, not with market fluctuations.

A written investment philosophy provides clarity during uncertain times

2. Study Investment History

Understanding market history helps you recognize patterns and maintain perspective. Read about major market events, bubbles, and crashes to internalize how markets work over long periods.

Books like “Devil Take the Hindmost” by Edward Chancellor or “This Time Is Different” by Reinhart and Rogoff provide valuable historical context that helps develop a more balanced view of current market conditions.

3. Practice Scenario Analysis

For each investment, consider multiple possible outcomes—both positive and negative. Ask yourself: “What if I’m wrong? What’s the worst that could happen? What needs to go right for this to work?”

This practice develops probabilistic thinking and helps you prepare mentally for different market environments. It also reduces the likelihood of unpleasant surprises that might trigger emotional reactions.

4. Seek Opposing Viewpoints

Deliberately expose yourself to investment opinions that contradict your own. If you’re bullish on a particular asset, seek out the strongest bearish arguments you can find.

This practice strengthens your analysis, helps identify blind spots, and builds the mental muscle of independent thinking. It’s not about changing your mind on every issue, but about testing your convictions.

5. Find a Mindset Mentor

Identify an experienced investor whose approach resonates with you, and study their thinking process. This could be someone you know personally or a well-known investor who shares their philosophy publicly.

Pay attention not just to what they invest in, but how they make decisions, handle mistakes, and think about risk. Their example can help you develop similar mental habits.

Ready to Assess Your Investor Mindset?

Take our free investor mindset assessment to identify your strengths and areas for improvement. You’ll receive a personalized report with specific recommendations to help you think more like the pros.

Conclusion: The Mindset Advantage

Strategy matters in investing, but mindset matters more. The mental frameworks you bring to your investment decisions will ultimately determine your success more than any specific technique or approach.

The good news is that these mindsets can be developed with practice and awareness. By focusing on long-term thinking, probabilistic reasoning, risk management, independent thinking, and continuous learning, you can build the mental foundation that supports successful investing in any market environment.

With the right mindset, market volatility becomes opportunity rather than threat

Remember that developing these mental frameworks is a journey, not a destination. Even the most successful investors continue to refine their thinking throughout their careers. The key is to start the process and commit to ongoing improvement.

I encourage you to take a moment now to audit your current investment mindset. Are you making decisions based on short-term emotions or long-term principles? Are you thinking independently or following the crowd? Your answers will reveal where you need to focus your development efforts.

Take Your Investor Mindset to the Next Level

Want personalized guidance on developing your investor mindset? Schedule a consultation to discuss your specific challenges and create a customized plan for thinking more like the pros.